One of the most effective interviewers was the legendary television journalist Barbara Walters. She got her subjects to tell her things they hadn’t even revealed to their own families. When asked how she did it, Walters answered, “I do so much homework, I know more about the person than he or she does about himself.”

Walters would write over 100 questions on 3-by-5 cards, put them in order, and throw some away. She would spend days going over them before the interview. “Here’s the important thing, you’ve got to know your questions, so you can throw them all away if you have to,” she said.

That level of planning is not realistic for an audit interview, but it testifies to the value of good planning. Too often, internal auditors take about 15 minutes to jot down a list of questions and consider that sufficient planning. Auditors should work to improve their techniques to better prepare for interviews.

Obtain Background Information

Auditors should first find out as much as possible about the activities that will be discussed. The more auditors understand before the interview, the better follow-up questions they can ask. Auditors should look at:

- Prior workpapers, especially risk/control matrices, flowcharts, and narratives describing control systems.

- Previous audit reports.

- The client’s organization charts, policies and procedure manuals, and current systems documentation.

- The interviewee’s job description.

The interviewee is the person auditors are preparing to interview and is one of the many clients in the area being audited. Auditors can also seek information on the interviewee’s personality, experience, knowledge, etc., from sources such as:

- Internal auditors who have worked with the interviewee (the best source).

- The interviewee’s supervisor.

- The interviewee’s co-workers, if there’s a possibility to do this tactfully.

Auditors should find out if any operational or organizational changes may affect the interviewee. Such changes may affect the person’s emotional state, which is good to anticipate. Asking how the person feels about the change demonstrates that the auditor values his or her viewpoint, and the answer may provide valuable information.

Define the Purpose of the Interview

To help steer the focus for the interview, auditors should determine what information the interviewee can provide to help accomplish the audit objectives. The purpose of the interview is not just to find out how employees perform their work, but why that work is important to achieving the organization’s objectives. Keeping the purpose in mind can keep the interview on track, especially if it starts to go in an unhelpful direction.

Prepare Relevant Questions

Auditors must ask a combination of questions to obtain the information they need from the interview. To do so, they must understand the strengths and weaknesses of different types of questions.

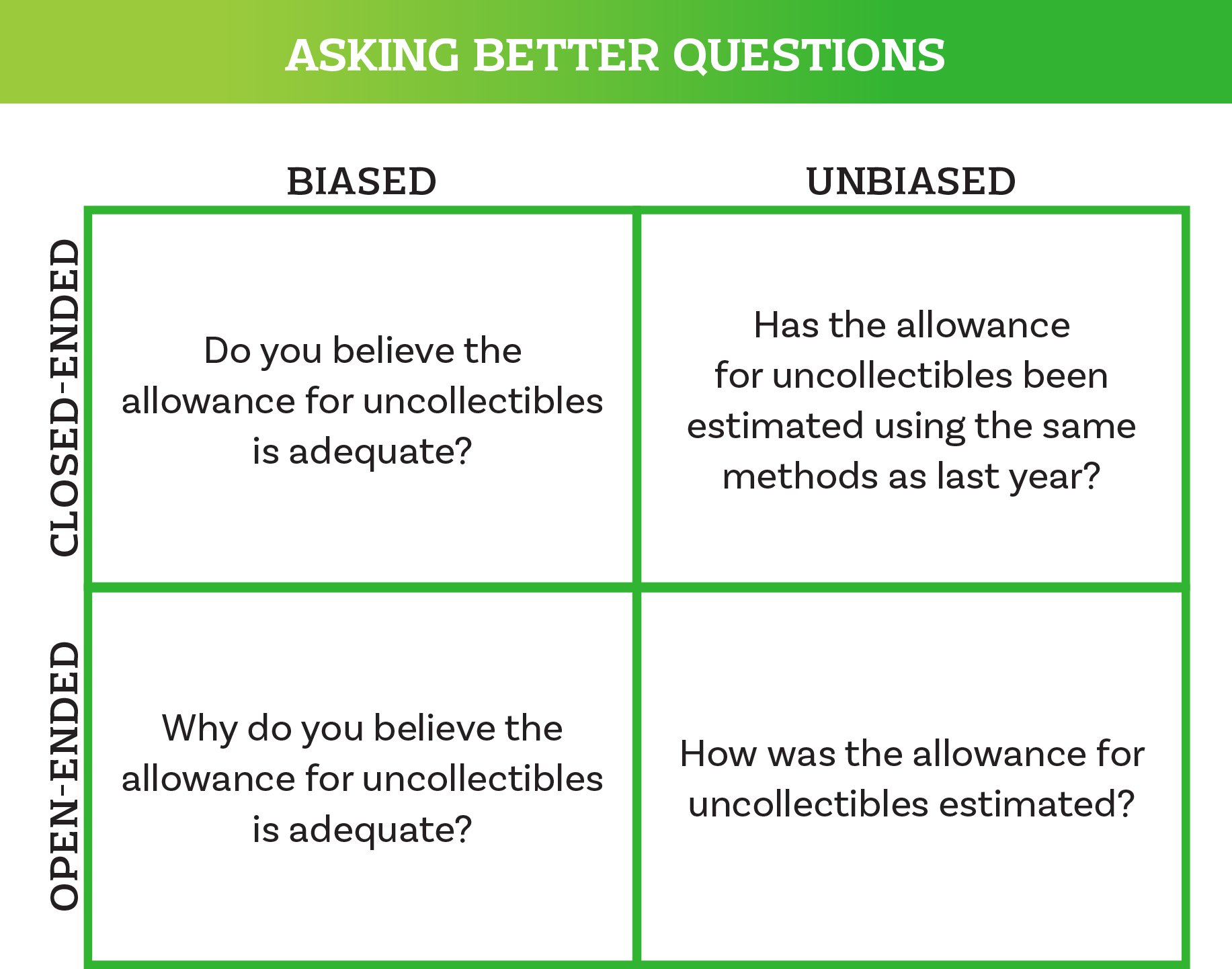

Open-ended questions ask for an explanation or elaboration. They enable interviewees to determine the range and scope of their responses. These questions also invite the person to volunteer important information the auditor has not asked about.

Closed-ended questions can be answered with “yes” or “no.” They are helpful in obtaining or confirming specific facts. These questions enable the auditor to obtain more information in a short time.

Biased questions are often referred to as “leading” or “loaded” questions because they contain clear cues about the answer the auditor expects. Asking biased questions is a common mistake and can result in a failure to gain valid and relevant answers.

Conversely, unbiased questions do not contain such cues to the expected answer. Auditors should phrase all questions in an unbiased manner (see “Asking Better Questions” on this page).