On the Frontlines: Training Teams With What They Already Know

Blogs Betina G. Airoldi, CIA, CRMA, CAMS, PMP Jun 23, 2025

It is not uncommon for the CAE to encounter situations during engagement planning where the audit team lacks experience in the specific processes under review. It is unrealistic to expect each team member to have in-depth knowledge of every process, particularly operational ones.

However, it is essential to provide them with the necessary training and to hold discussions about risks and controls to ensure their work conforms with the IIA’s Global Internal Audit Standards. In particular, Domain V: Performing Internal Audit Services requires internal auditors to effectively plan and conduct engagements.

One of the most effective ways to train and develop a high-performance team is to help them relate the process under review to something familiar, like routine activities they do in their daily lives. It is up to the trainer to be creative and to engage their imagination. Do not forget that one of the factors that makes internal auditing exciting is the chance to work on different projects and see the business through a variety of lenses.

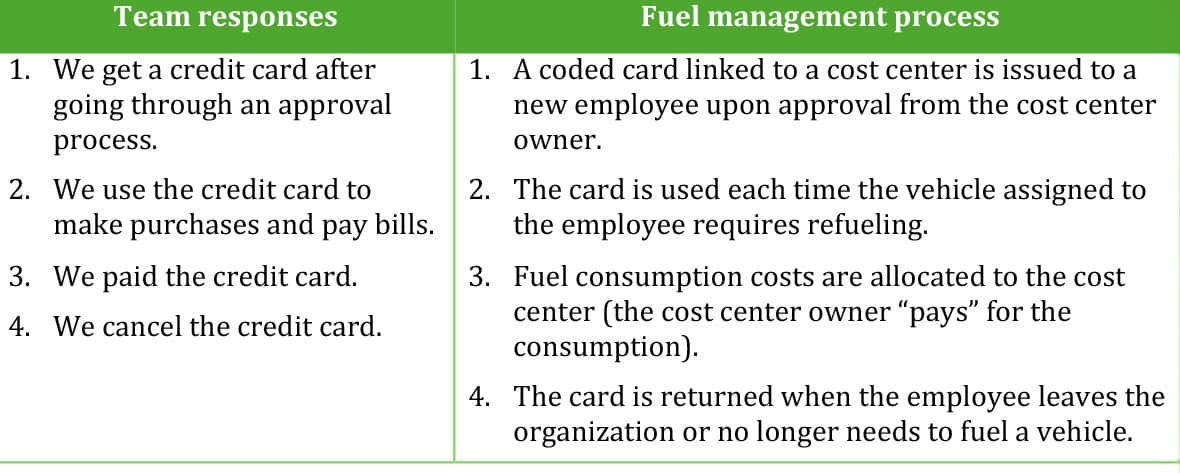

Here is one example of applying this approach, starting with a simple question: What does a fuel management process have in common with how you use credit cards? Let’s discuss.

Several years ago, my team was planning an audit of the new fuel management process at a mine site that was new to us. My team did not know much about fuel management, but they were eager to learn. I started by asking the audit team to walk me through everything they do with a credit card, from getting one to managing and using it. Then I drew a parallel with the process under review to their own experiences with credit cards to help them relate to some key activities. Here is what the overall picture looked like:

Although this was a high-level discussion, and other strategic activities within the process needed to be walked-through and reviewed, once the team related to the process, they understood the basics, brainstormed expected key controls, and began thinking about potential test procedures. For example, they suggested performing analytics on the card database to ensure:

- All cards were properly approved at the time of their activation.

- No cards were assigned to employees who left the organization.

- No active cards were issued to employees without an assigned vehicle.

- Active cards were assigned to the proper cost center.

- There were no duplicate cards in the database.

In addition, they discussed other matters, such as appropriate segregation of duties, controls over card lifetime, custody and code assignment, as well as effective review and analysis of cost center expenditures in terms of fuel consumption.

Experienced internal auditors, not necessarily with industry-specific knowledge but with solid field experience, should be able to think outside the box and guide junior auditors in drawing connections to their own experiences during the planning phase. This approach helps junior team members build a solid foundation and gain confidence in their work. Rather than strictly adhering to theory or a rigid methodology, encourage them to explore and discover insights independently.

The views and opinions expressed in this blog are those of the author and do not necessarily reflect the official policy or position of The Institute of Internal Auditors (The IIA). The IIA does not guarantee the accuracy or originality of the content, nor should it be considered professional advice or authoritative guidance. The content is provided for informational purposes only.